There are many excellent and well performing companies. These companies sell stocks or shares, which is similar to buying part of the company. If the company is well performing, the value of the stock will increase, and if you decide to sell it, you will gain some money.

Indexes or indicies are stocks that track multiple stocks, like a box full of more boxes, some well-known stock indexes include the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, and FTSE 100. These indexes represent different aspects of the overall market, such as the largest 500 companies in the US (S&P 500) or the performance of technology-related stocks (NASDAQ Composite). Each index has its own methodology and selection criteria, making it unique in terms of the securities it incorporates.

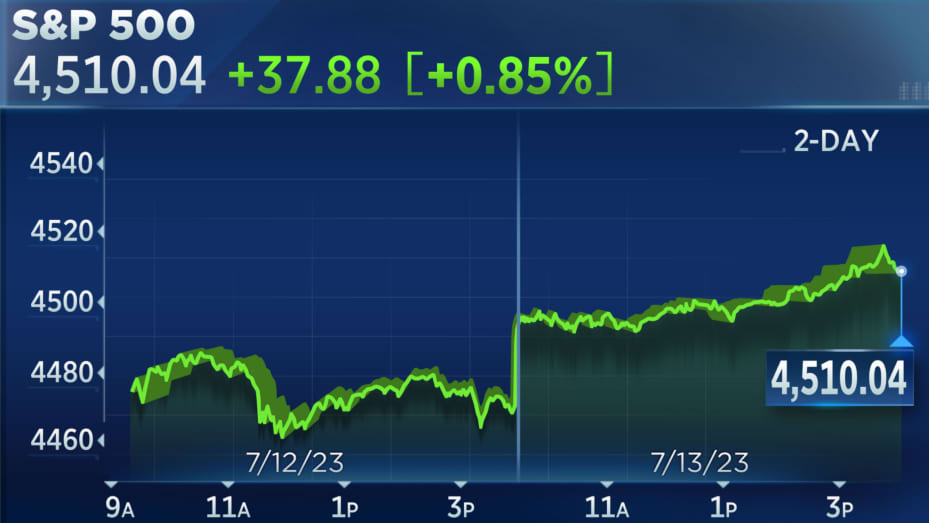

There are many Indexes, one of the most popular ones is SP500. It is an index that follows the top 500 networth companies. Whenever the 500 companies go up, so does SP500, when the companies go down in value, so does SP500.

An ETF of a index like SP500, acts like a copy, as it follows extremely similar trends as the index. An example is IVV, it is an ETF of SP500, it is around 10 times cheaper per share, but will increase and decrease by equal proportions as SP500. If you have any extra amount of money just sitting in your saving account, it would be wise to invest in SP500, as after a few years, it would give you a profit. Around 10-20% per year, compared to banks 0.47% average.